Batwa - 2014 to 2020

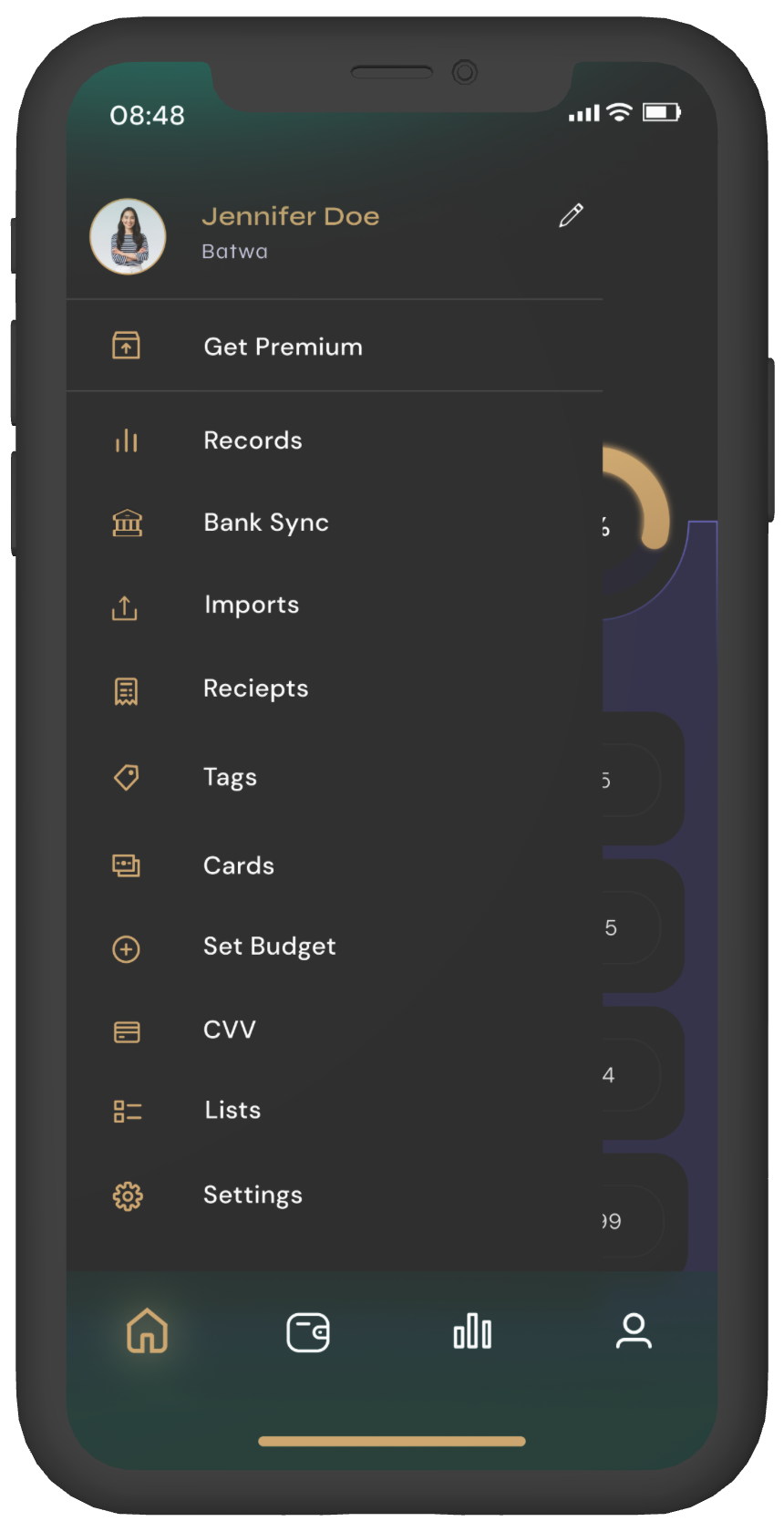

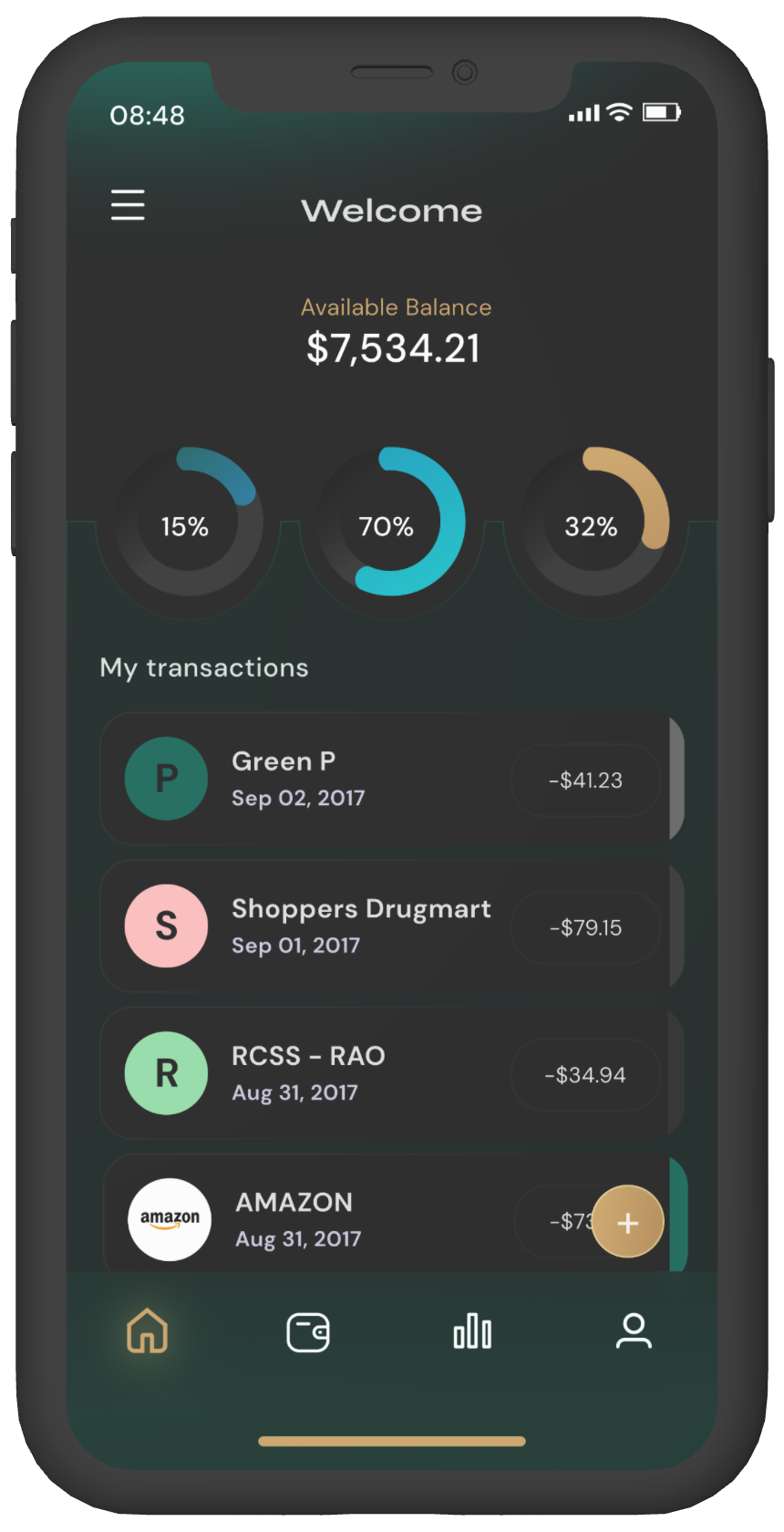

Batwa is an AI-powered personal financial management app designed to provide users with valuable insights, helping them save and plan their finances to achieve their goals. This UX case study focuses on the process of enhancing the user experience for Batwa, with a focus on making financial management efficient, intuitive, and goal-oriented.

Context

Problem Statement

Numerous individuals grapple with the challenge of monitoring their expenditures, often resulting in excessive spending, indebtedness, and financial anxiety. When individuals lack a precise comprehension of how they allocate their funds, making informed financial choices and attaining their monetary objectives becomes a formidable task.

Solution

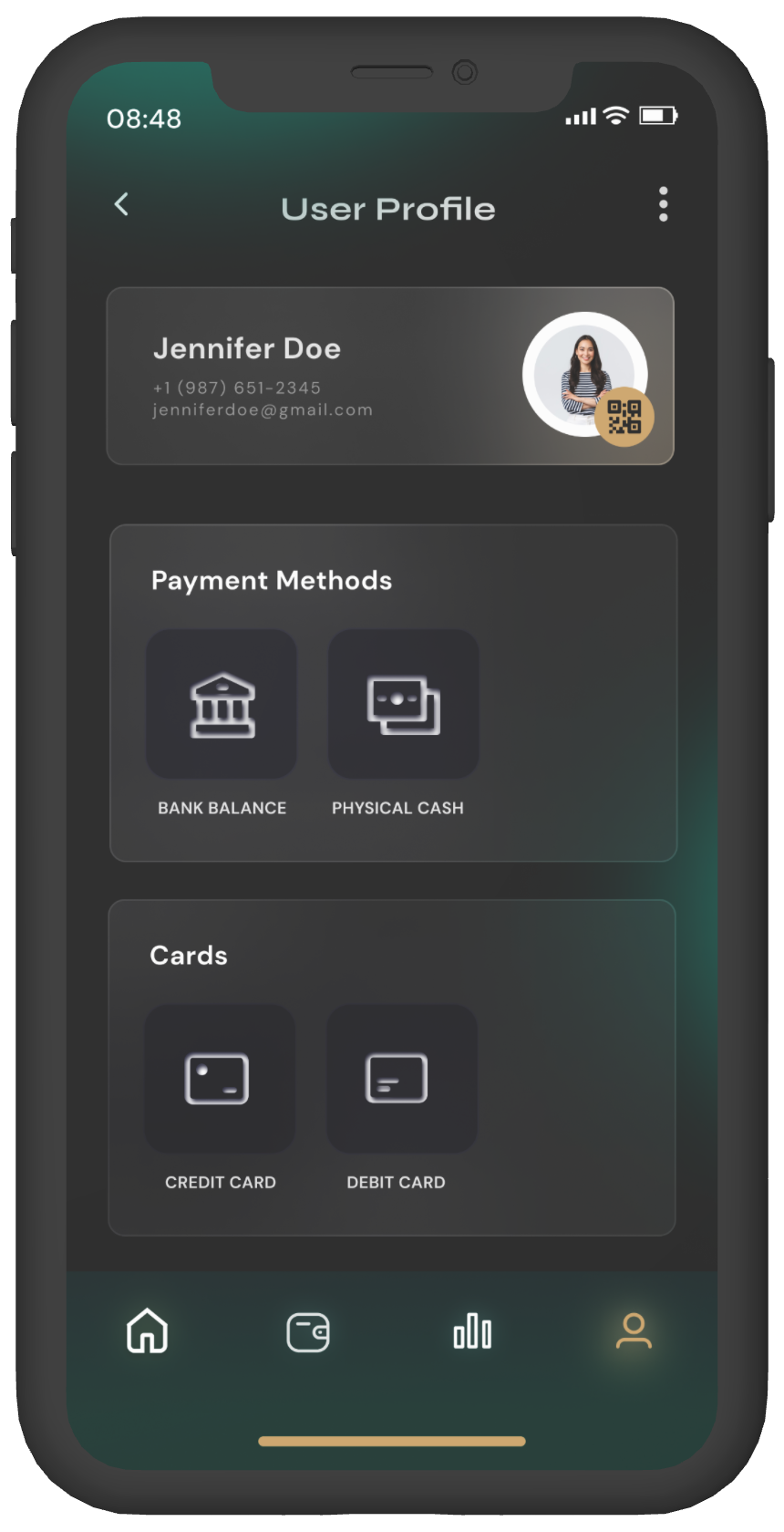

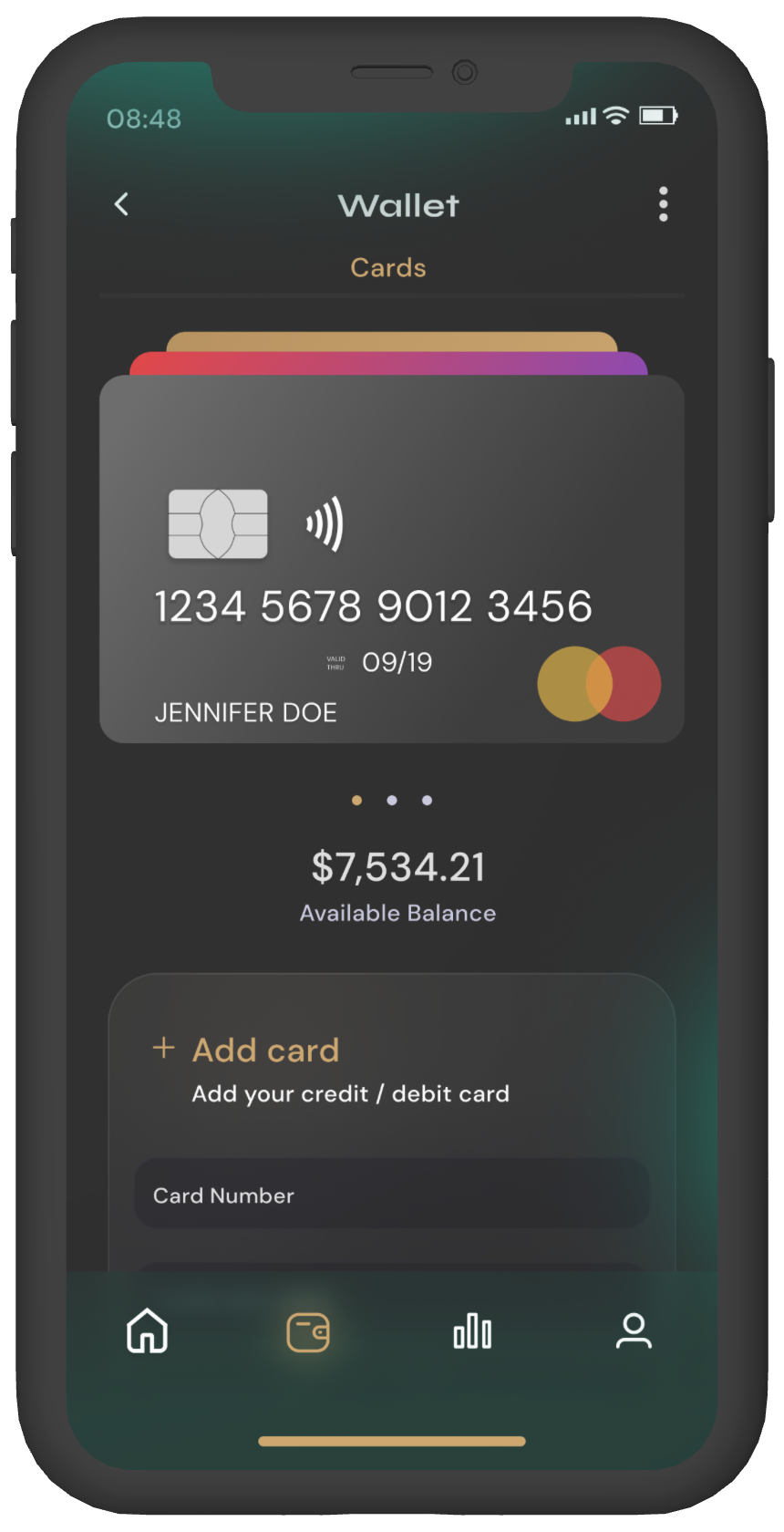

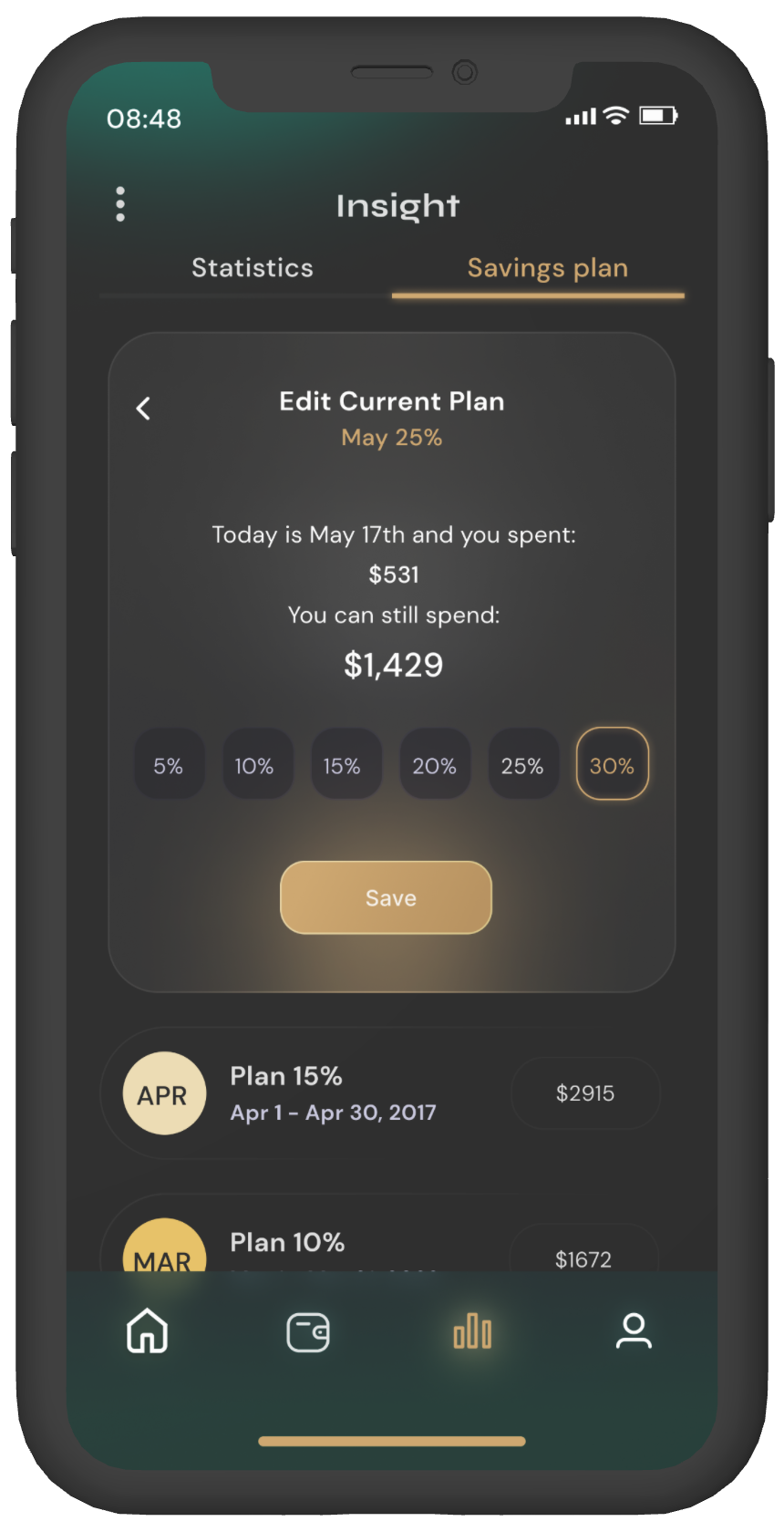

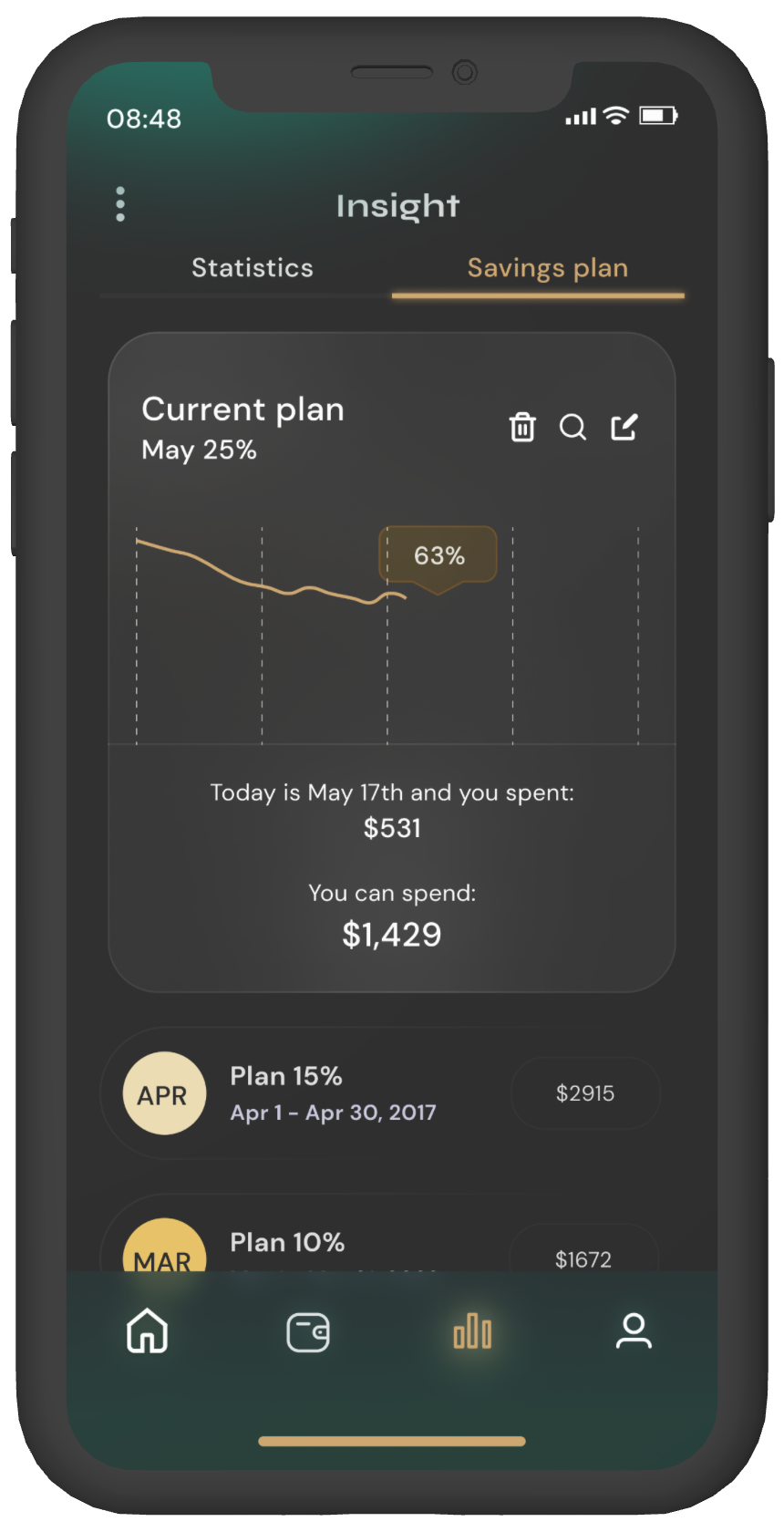

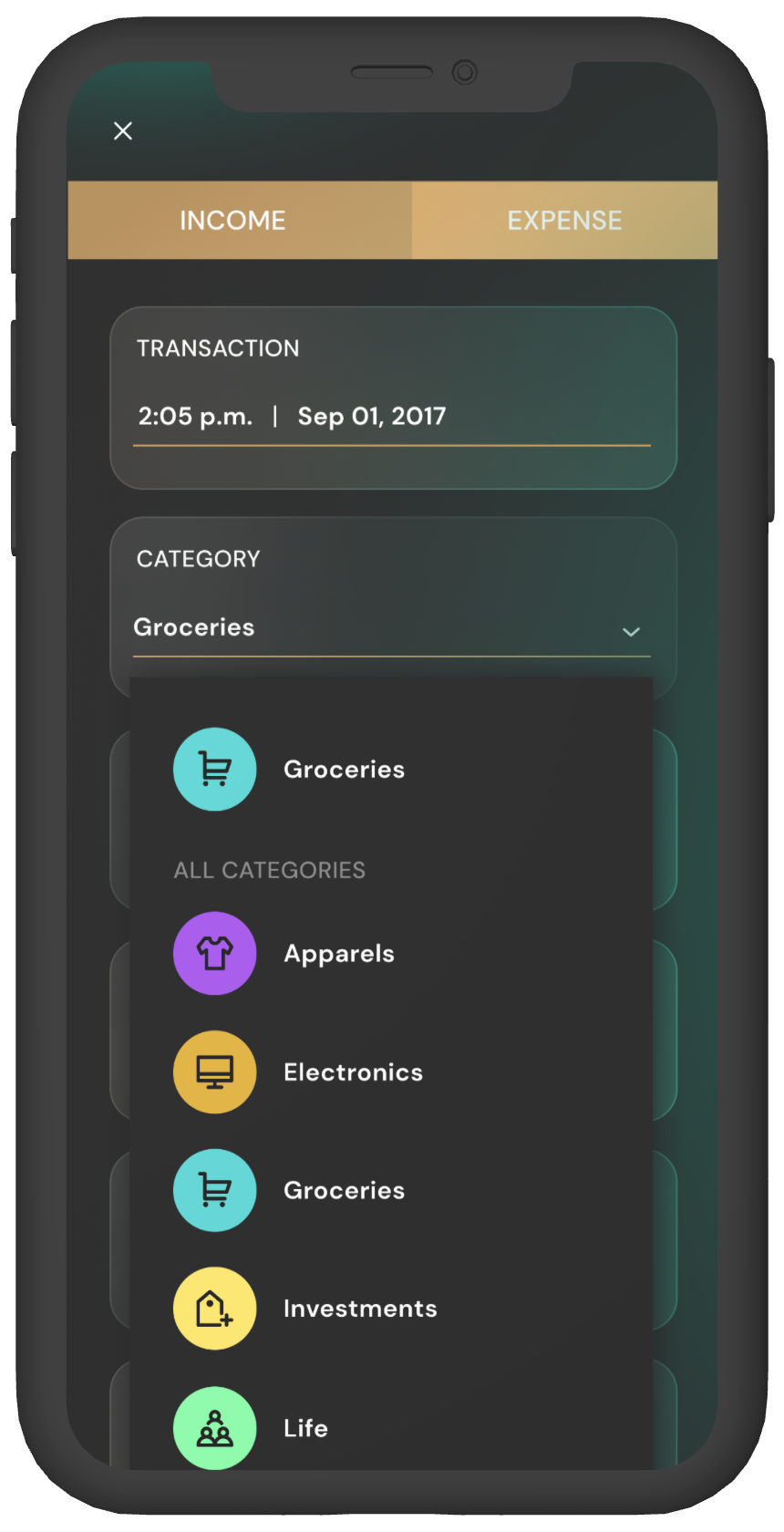

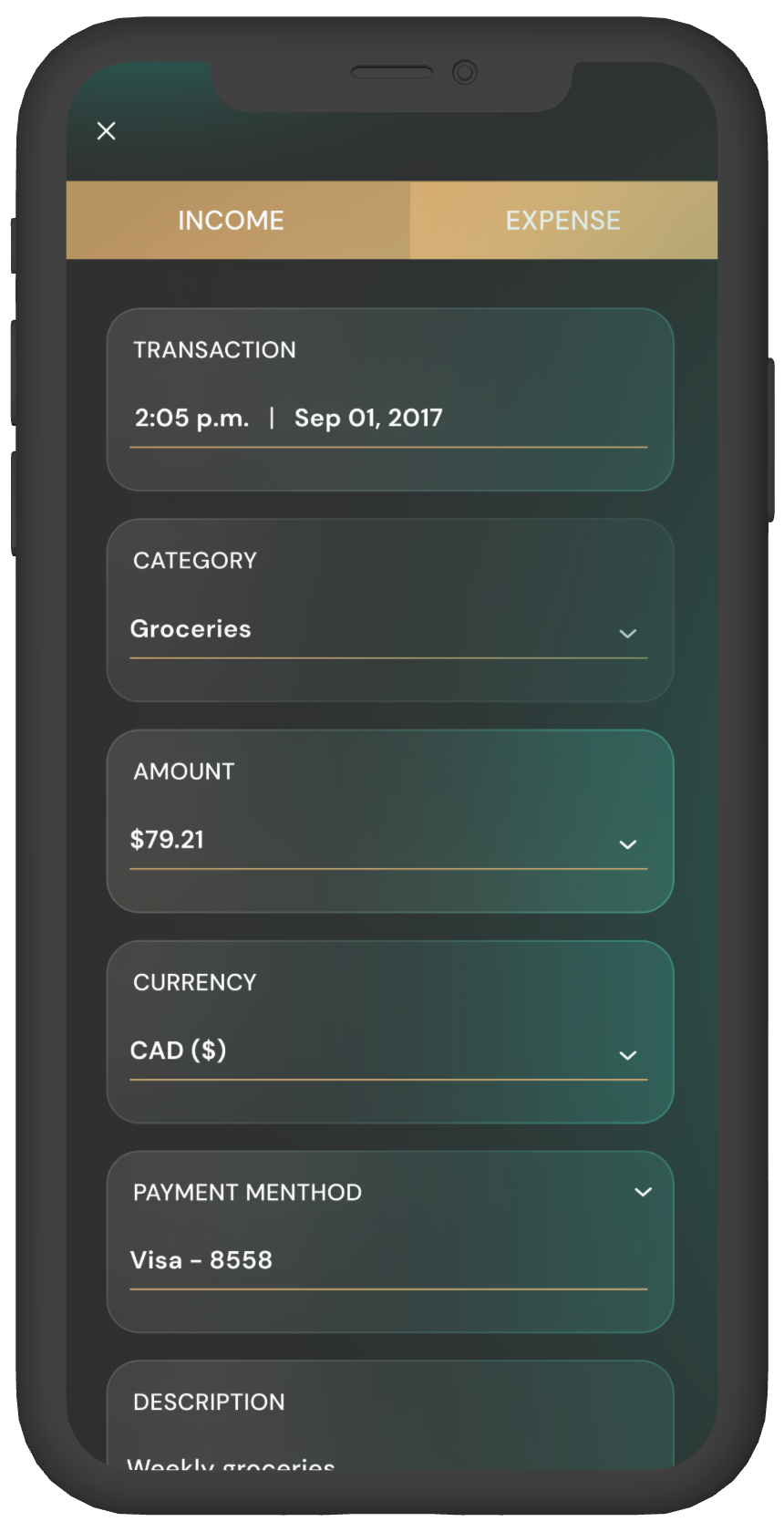

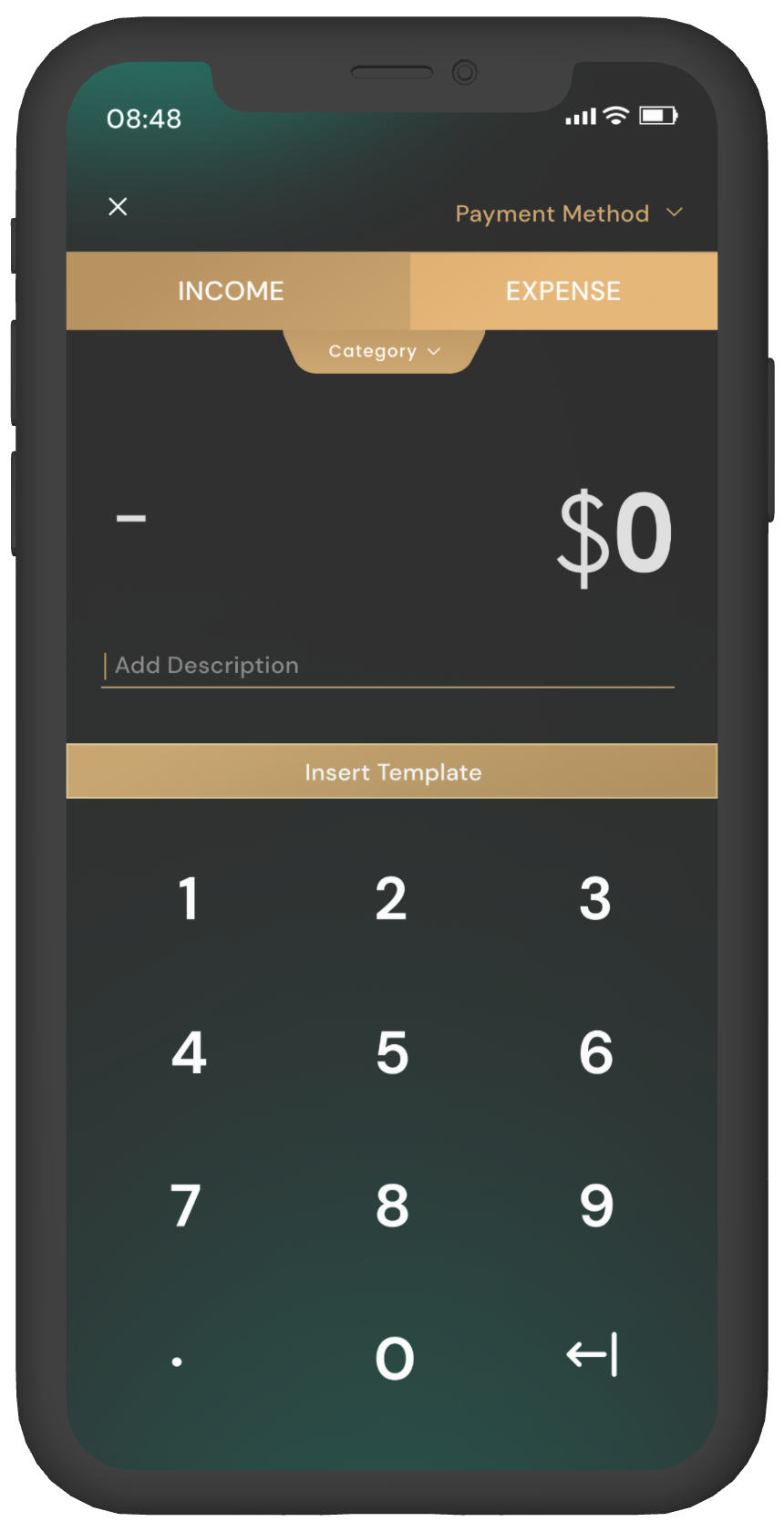

Addressing this issue, an expenditure-monitoring application can offer a straightforward and user-friendly solution. It allows individuals to effortlessly record and classify their expenses, assigning each purchase to a particular category, be it food, transportation, entertainment, and more. This process empowers users to gain a comprehensive understanding of their spending patterns, pinpoint opportunities for cost reduction, and bolster their savings.

Target Market

Young Adults: Novice money managers in their early adulthood can benefit from this app as it assists in cultivating prudent budgeting habits and preventing excessive spending.

Small Business Owners: Entrepreneurs with small enterprises, requiring meticulous expense tracking for taxation and accounting purposes, can leverage the app's capacity to categorize and monitor their expenditures effectively.

Savvy Savers: Thrifty consumers keen on economizing and adhering to a budget can employ the app to oversee their expenses and pinpoint opportunities for cost-cutting.

Globetrotters: Jet-setters seeking to maintain a tight rein on their spending while on the go can employ the app to record their travel expenses and adhere to a predefined budget.

Students: College attendees, navigating the complexities of academics and part-time work, can utilize the app to track their expenditures and stay in control of their financial affairs.

Research & Discovery

Need to save money

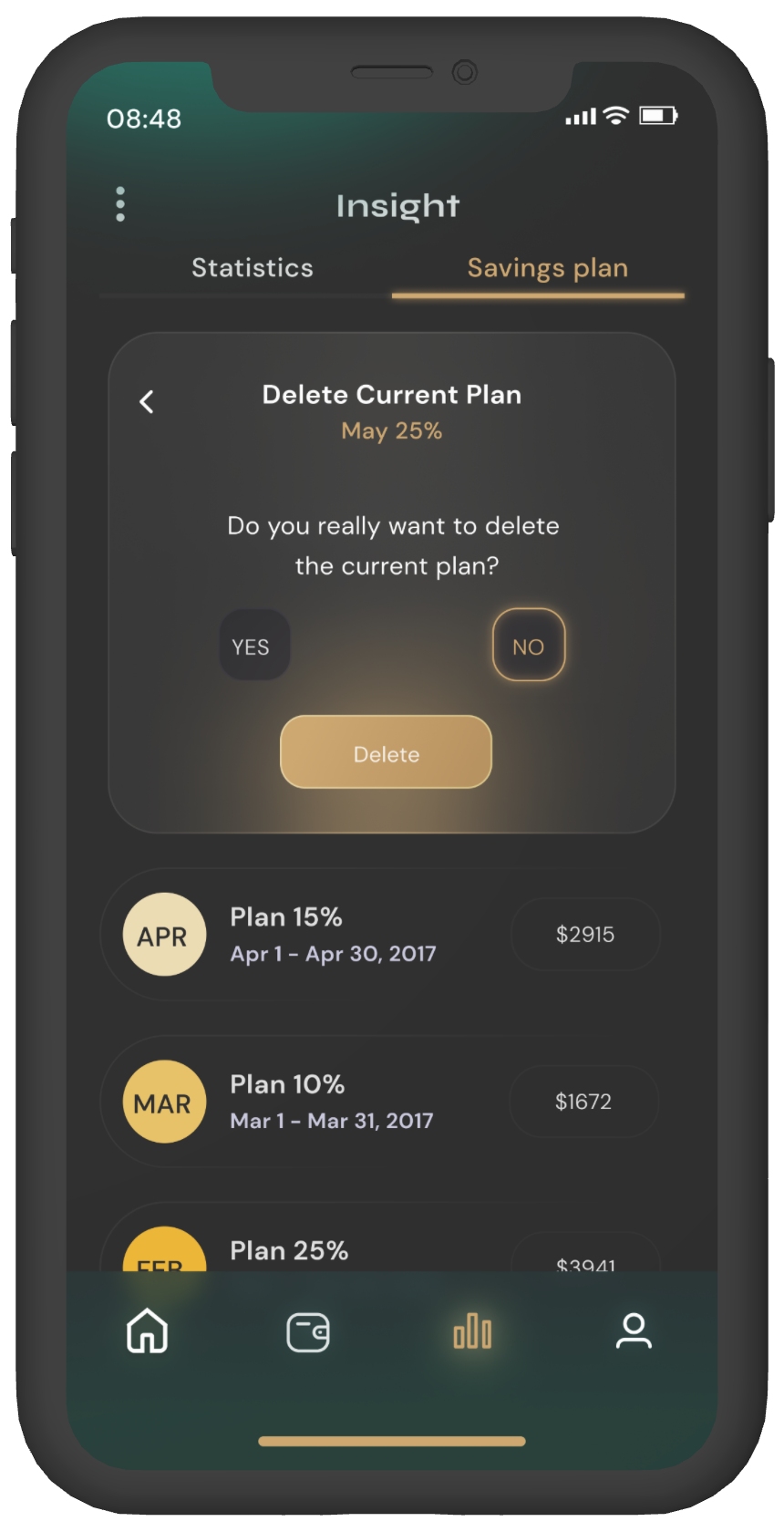

Cultivating a Savings Routine: Individuals who prioritize savings often develop the habit of regularly allocating a portion of their income. They commonly achieve this by implementing automated savings or establishing dedicated savings accounts.

Pursuit of Financial Stability: Many individuals embark on a savings journey with the aim of attaining financial security and peace of mind. They seek to create a financial cushion to address unexpected expenses or emergencies.

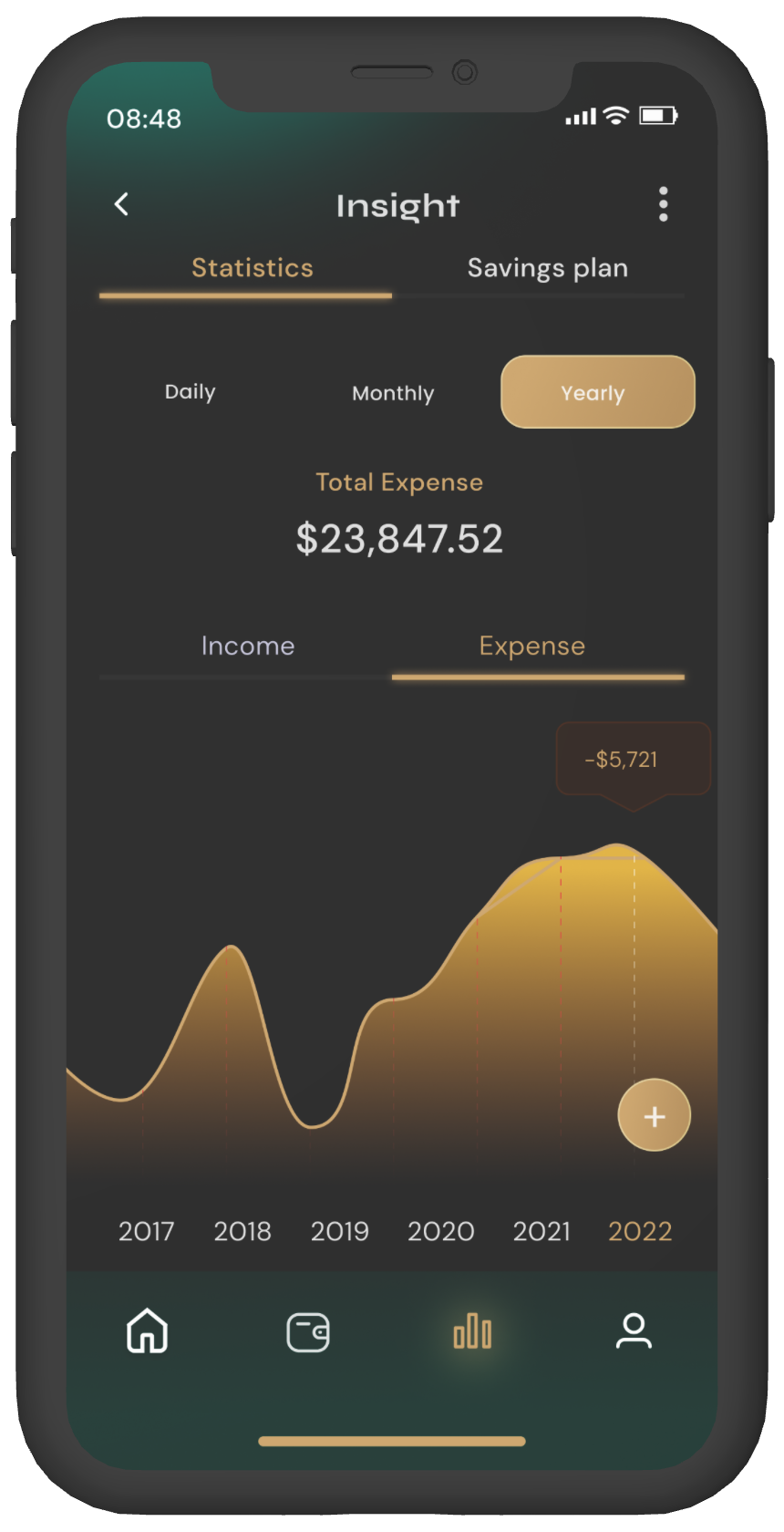

Focused on Long-Term Objectives: Savers frequently work towards long-term aspirations, such as homeownership, retirement planning, or entrepreneurial ventures.

Debt Reduction and Enhanced Financial Well-Being: Saving money can also serve as a means to reduce indebtedness and enhance overall financial health.

Avenues of saving

Budget Management: Savers frequently engage in budgeting, employing this tool to effectively control their expenditures and ensure they allocate a portion for savings.

Expense Prioritization: Those who practice saving money tend to place a premium on essential expenses, like housing, sustenance, and transportation, before considering discretionary spending.

Deferred Gratification: Saving enthusiasts often embrace the concept of delayed gratification, demonstrating their willingness to postpone purchases until they've accumulated sufficient funds to afford them.

Lifestyle Decisions: Savers often make lifestyle choices that facilitate increased savings, such as residing in more cost-effective locales, driving older vehicles, or preparing meals at home instead of dining out.

Personas

Responsible Rachel

Age: 28

Occupation: Marketing Manager.

Financial Goals: Saving for a down payment on a house.

Habits: Diligently tracks every expense, sticks to a strict budget, enjoys researching and investing in stocks, and automates savings every month.

Pain Points: Wants an app that provides detailed budgeting features, investment advice, and goal tracking tools to help her reach her homeownership goal faster.

Frugal Fred

Age: 35

Occupation: Software Engineer.

Financial Goals: Achieving early retirement.

Habits: Extremely frugal, always looks for ways to save money, invests heavily in stocks and retirement accounts, and tracks every penny spent.

Pain Points: Requires an app with advanced investment tracking, retirement planning tools, and a feature that helps him analyze the impact of every expense on his early retirement plan.

Busy Bee

Age: 42

Occupation: Small business owner.

Financial Goals: Building an emergency fund and expanding the business.

Habits: Juggles multiple responsibilities, struggles with keeping track of business and personal finances, desires a simple app that syncs with her business accounts, and sends reminders for regular savings.

Pain Points: Needs an app with business expense tracking, tax-related features, and easy-to-understand financial reports.

Student Sam

Age: 20

Occupation: College student working part-time.

Financial Goals: Paying off student loans and saving for a post-graduation trip.

Habits: Has limited income, uses the app to budget for necessities, shares expenses with roommates, and saves small amounts whenever possible.

Pain Points: Seeks a user-friendly app with expense-sharing capabilities and easy debt-repayment tracking, and helps set achievable short-term goals for their trip.

Journey Map

Awareness: Rachel discovers the app either through an online search for expense-tracking tools or via a recommendation from a friend or family member.

Interest: Rachel engages with the app by reading reviews and examining its features through screenshots on the app store. Impressed by its clean, user-friendly interface, she decides to proceed with the download.

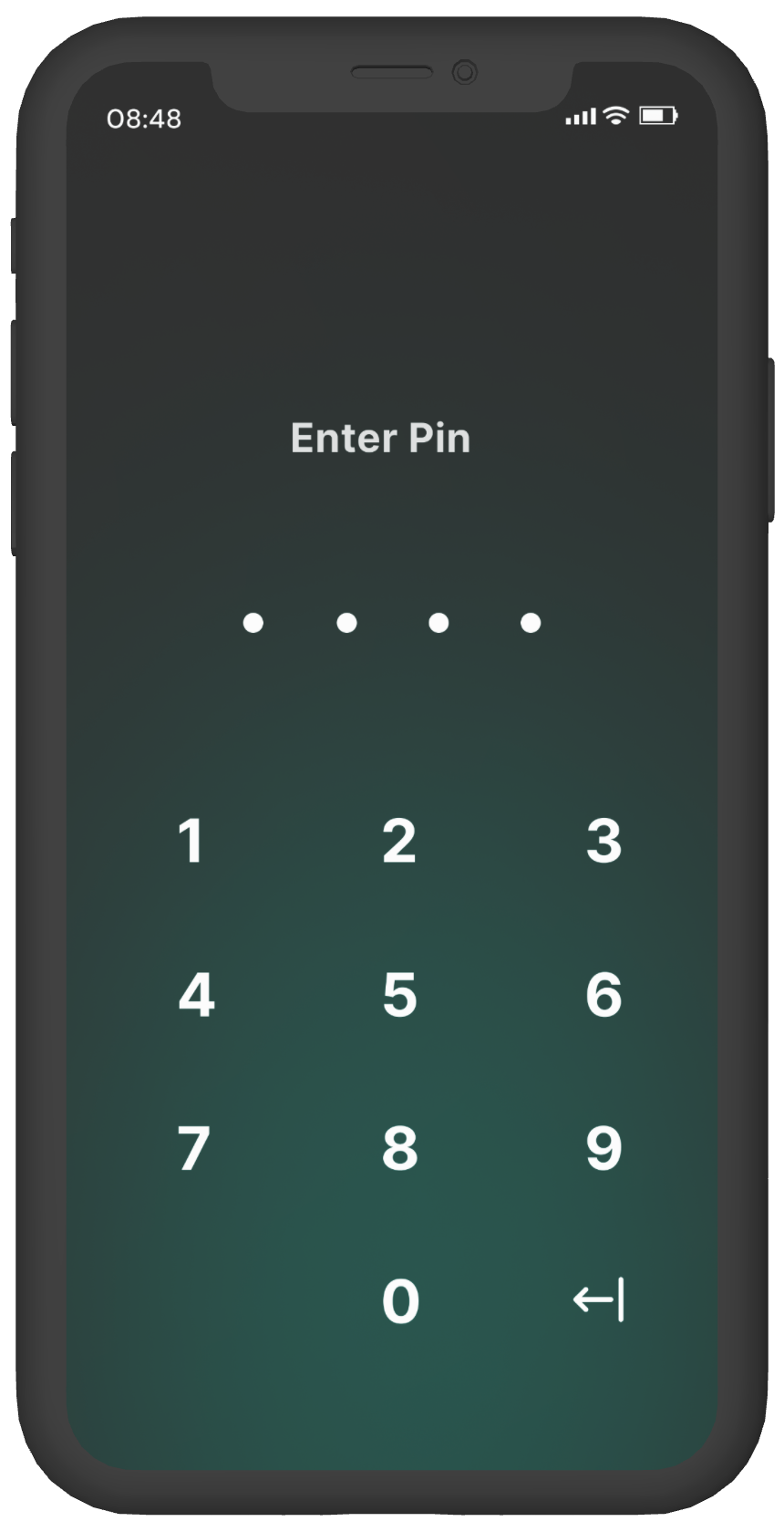

Onboarding: Rachel initiates her account setup, inputting income and expenses while crafting a budget. She is pleased with the app's intuitive usability and values the personalized guidance it offers for budget creation.

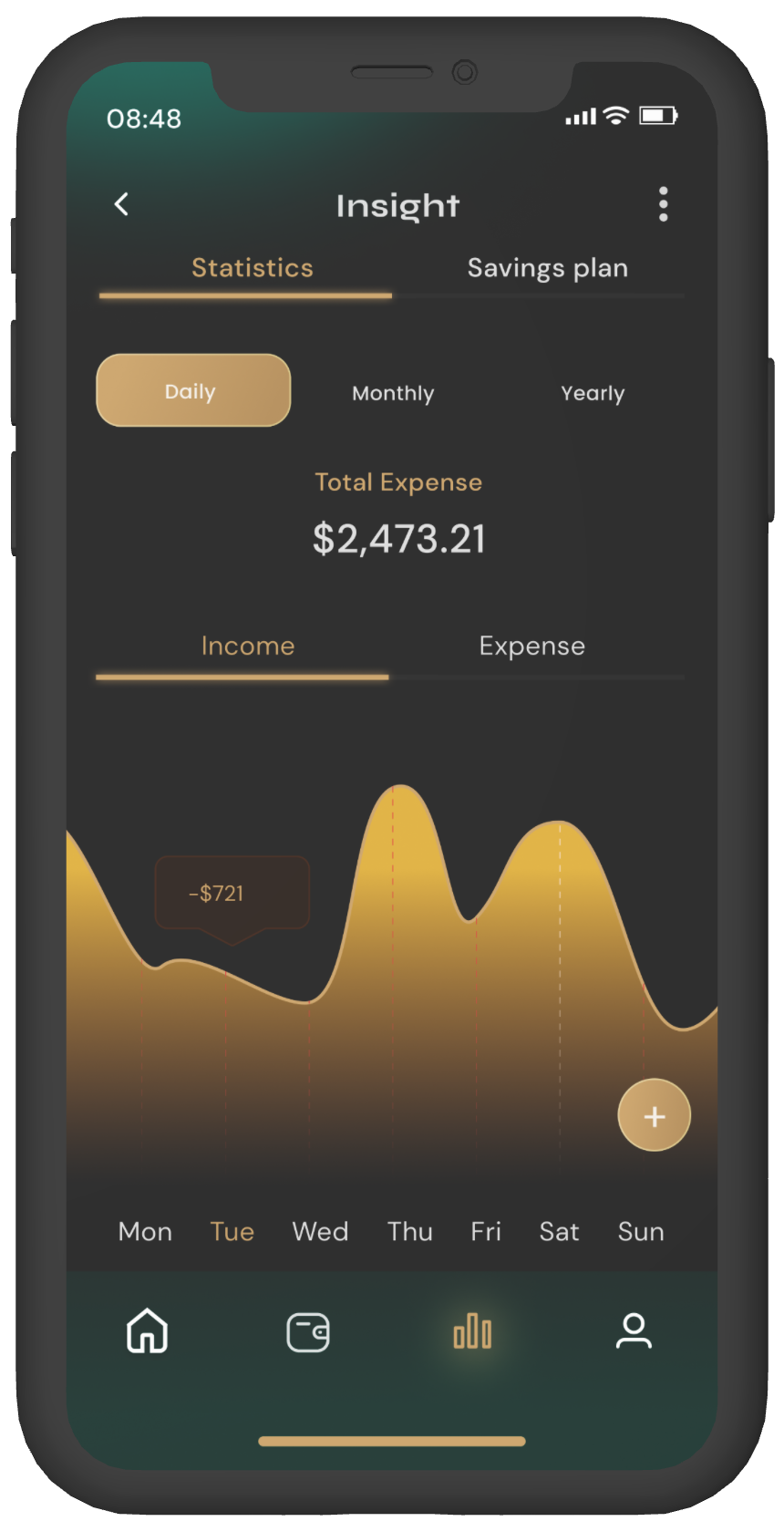

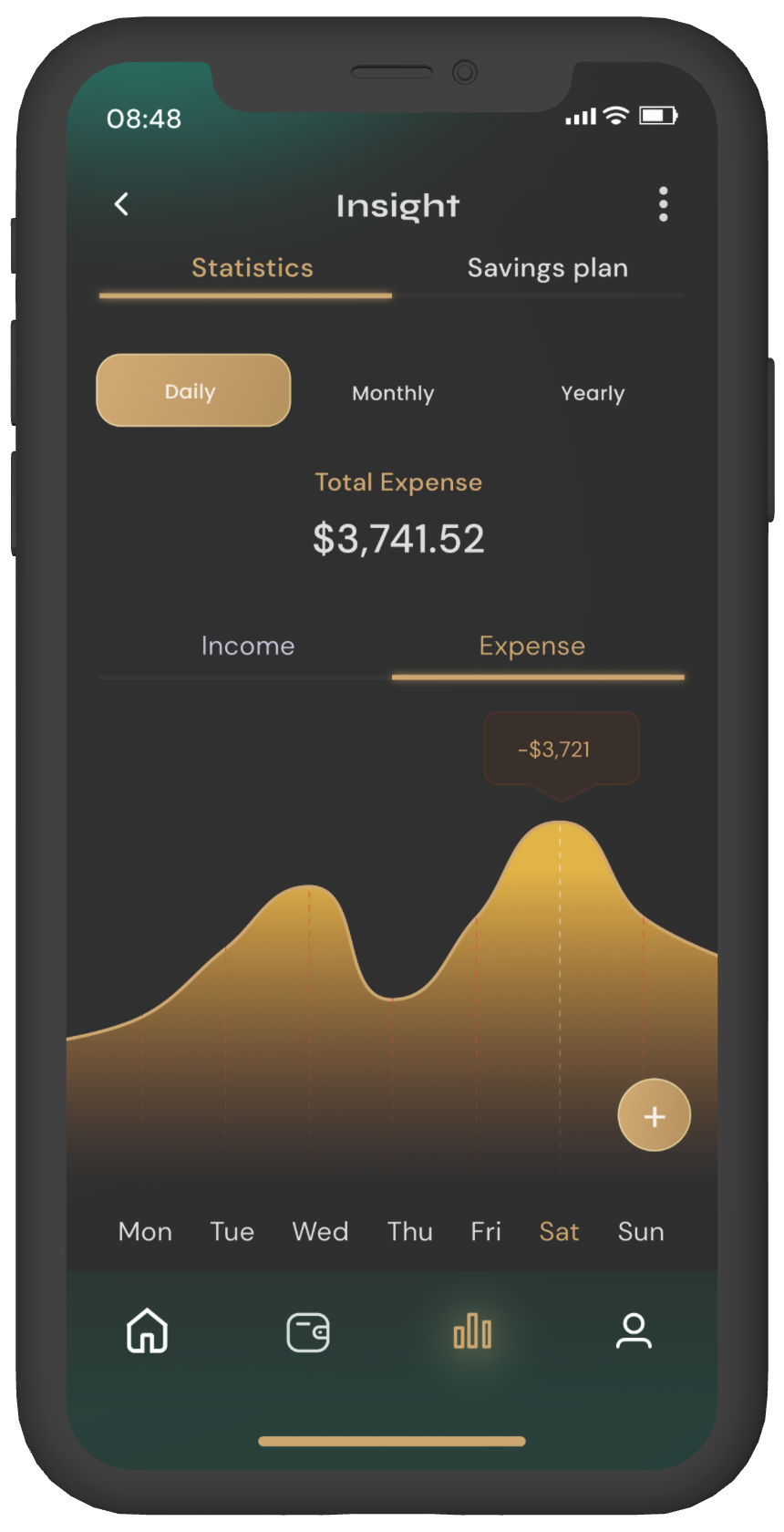

Usage: Rachel begins to actively employ the app for consistent expense tracking and adhering to her budget. She appreciates the app's automated expense categorization and its ability to identify overspending. The app's reminders further assist her in maintaining budget adherence.

Delight: Rachel discovers that the app significantly enhances her financial organization and overall financial well-being. Her positive experience leads her to recommend the app to friends and family and leave a glowing review on the app store.

Advocacy: Rachel evolves into a dedicated user of the app, utilizing it over an extended period to manage her finances. She may also refer new users to the app and offer constructive feedback to the developers for continual enhancement of its functionality and features.

The UX transformation of Batwa created a powerful and intuitive financial management app that addressed users' needs for simplified financial planning and actionable insights. By focusing on AI-driven insights, a user-friendly interface, goal-oriented features, and intuitive data entry, we successfully increased user engagement, satisfaction, financial discipline, and received positive reviews.

Continuing to prioritize user-centered design principles is crucial for Batwa to maintain its success and evolve to meet the ever-changing needs and goals of its users in the dynamic world of personal finance.